How Does A Monopoly Have Complete Control Over The Price Of Its Product?

Monopoly

A marketplace with a single seller just many buyers

What is a Monopoly?

A monopoly is a marketplace with a single seller (called the monopolist) but with many buyers. In a perfectly competitive market, which comprises a big number of both sellers and buyers, no single buyer or seller can influence the cost of a commodity. Dissimilar sellers in a perfectly competitive market place, a monopolist exercises substantial control over the market price of a commodity.

The quantity sold by the monopolist is unremarkably less than the quantity that would be sold in a perfectly competitive firm and the price charged by the monopolist is usually more than than the price that would exist charged by a perfectly competitive firm. While a perfectly competitive firm is a "toll taker," a monopolist is a "price maker." Similar to a monopoly is a monopsony, which is a market with many sellers but only 1 buyer.

Understanding Monopoly

A monopolist tin can raise the price of a production without worrying about the actions of competitors. In a perfectly competitive market, if a firm raises the price of its products, it will usually lose market share as buyers motion to other sellers. Primal to understanding the concept of monopoly is understanding this unproblematic statement: The monopolist is the market maker and controls the corporeality of a article/product available in the market.

Even so, in reality, a profit-maximizing monopolist can't just charge any price information technology wants. Consider the following example: Visitor ABC holds a monopoly over the market for wooden tables and can charge any price it wants. Nonetheless, Company ABC realizes that if information technology charged $x,000 per wooden table, no one would purchase whatsoever and the visitor would have to shut down. It is because consumers would substitute other bolt such as iron tables or plastic tables for wooden tables.

Thus, Company ABC will charge the cost that enables information technology to make the maximum profit possible. In club to do so, the monopolist must offset determine the characteristics of market place demand.

Understanding a Monopolist'south Conclusion

| Quantity (Q) | Cost | Full Revenue (TR) | Average Revenue (AR) | Marginal Revenue (MR) ∆TR/∆Q |

|---|---|---|---|---|

| TR/Q | ||||

| 1 | 10 | 10 | 10 | 10 |

| 2 | 9 | 18 | 9 | 8 |

| three | 8 | 24 | 8 | 6 |

| 4 | 7 | 28 | vii | iv |

| v | 6 | 30 | 6 | ii |

| six | 5 | xxx | 5 | 0 |

| seven | 4 | 28 | iv | -2 |

Consider the following example. Company ABC is the sole seller of wooden tables in a small town. The table above shows the demand curve faced past Company ABC, besides equally the revenue it can earn by selling wooden tables.

The first two columns show the demand curve faced by the monopolist. If the monopolist supplies only one wooden table to the market, it can sell that table for $10. If the monopolist produces and supplies 2 wooden tables to the market and wants to sell both, it must lower the price to $9. Similarly, if the monopolist produces and supplies three wooden tables, information technology must lower the price to $8 to sell all of them.

The third column shows the full acquirement the monopolist can earn by selling varying quantities of wooden tables. The fifth column shows the monopolist's marginal acquirement. It is the additional revenue earned by the monopolist when it increases the quantity sold in the marketplace past ane unit of measurement.

For a monopolist, the marginal revenue is always less than or equal to the price of the commodity. This arises because the monopolist is the but seller in the market place and, thus, faces a market place demand curve that is downward sloping. For example, if Visitor ABC raises production and supply from three wooden tables to four wooden tables, its full revenue will increase by only $4, even though information technology charges $seven per wooden table.

The costs faced past the monopolist depend on the nature of the production procedure. Consider the example of a monopolist who wants to aggrandize product. The commodity produced by the monopolist requires a large quantity of skilled labor for its production, and skilled labor is in short supply.

Thus, as the monopolist raises output, it must pay more for skilled labor (as skilled labor gets scarcer, it charges a higher price). It results in the monopolist facing an upward rising marginal toll curve as shown below.

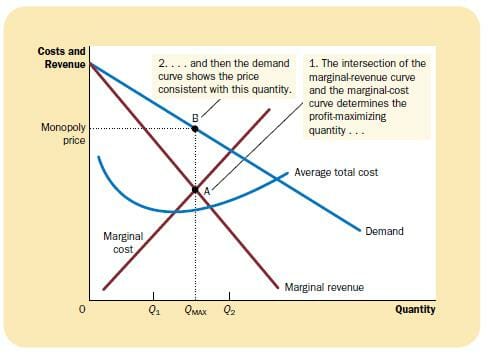

The monopolist produces that quantity of the commodity that reflects the equilibrium point of marginal acquirement and marginal toll. The marginal cost is the change in the total cost of product when production is increased past one unit of measurement. The cost charged by the monopolist depends on the market place demand curve.

Source: Principles of Economics by Due north. Gregor Mankiw

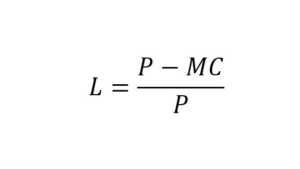

Measuring Monopoly Power – Lerner's Index

A mutual measure of monopoly ability in a market is provided past Lerner's Index.

L: Lerner'due south Index

P: Toll of the commodity

MC: Marginal cost of the commodity

Related Readings

CFI is the official provider of the global Fiscal Modeling & Valuation Annotator (FMVA)® certification plan, designed to help anyone become a world-course fiscal analyst. To continue learning and accelerate your career, encounter the following free CFI resources:

- Market Economy

- Command Economic system

- Law of Supply

- Inelastic Need

How Does A Monopoly Have Complete Control Over The Price Of Its Product?,

Source: https://corporatefinanceinstitute.com/resources/knowledge/economics/monopoly/

Posted by: lamberttherad.blogspot.com

0 Response to "How Does A Monopoly Have Complete Control Over The Price Of Its Product?"

Post a Comment